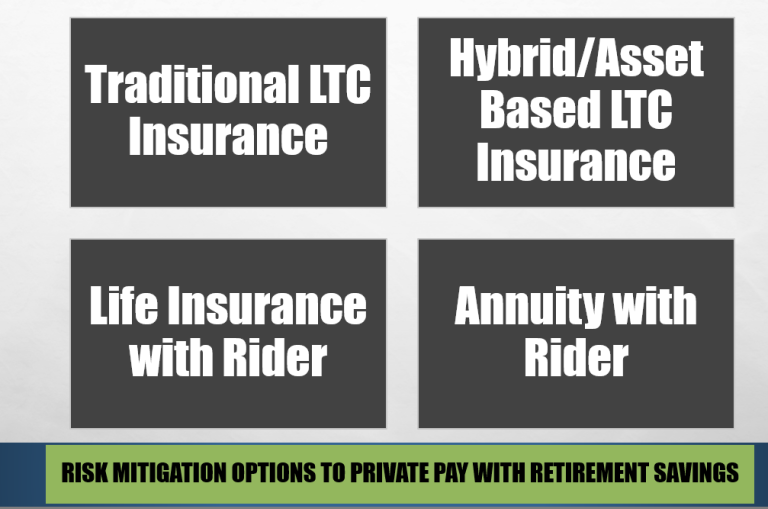

Long-Term Care insurance has evolved over the last 30 years. There are now product solutions that provide benefits whether you go on claim, pass away, or decide you want your money back. This type of LTC insurance is an asset in your overall portfolio that will protect your retirement savings.

Traditional LTC insurance policies can provide considerable protection from the cost of LTC. There are some PA state tax benefits to consider when looking at this option. Also, you may be able to pay for this product with an eligible HSA account. These types of policies are similar to car insurance. Usually, they have lower premiums than hybrid policies, but it is not an asset, more of an expense. You use it or lose it. Again, very similar to car insurance. You use your car insurance, or you lose it. There is no additional benefit to the premiums you paid other than having coverage for the period of time that you paid the premiums.

We also explore using term, IULs, and fixed annuities to see if they offer something that might benefit you and your family.

In today’s insurance landscape, hybrid life insurance solutions provide a powerful way to safeguard your future. These products combine the benefits of traditional life insurance with long-term care coverage, offering a flexible, asset-based approach to protecting both your retirement savings and your loved ones. With hybrid policies, you can rest easy knowing that you have coverage for long-term care needs, but also a death benefit for your family if you don’t require care. Additionally, many hybrid policies offer a money-back guarantee if you don’t use the benefits, providing peace of mind that your premiums won’t go to waste. By integrating hybrid solutions into your financial strategy, you’re not just planning for the possibility of long-term care expenses, but also building a safety net that adapts to your evolving needs. Explore these options to enhance your retirement plan with an insurance solution that offers both security and flexibility.

Schedule a time with Beth Mihalovich.